To improve and analyse this website. You can find more information on this in our privacy policy or under settings. There you can also object to the use of cookies.

eLearning courses on Compliance

Money Laundering

Our e-learning on anti-money laundering compliance makes employees sensitive to the importance of handling money in the company and strengthens their understanding of the need for rules and regulations.

- Seat Time: 8 Min.

- 30+ languages

- For all employees

Learning Objectives

- 1. What are the legal requirements? (national and international)

- 2. Implementation of the Money Laundering Act (GWG)

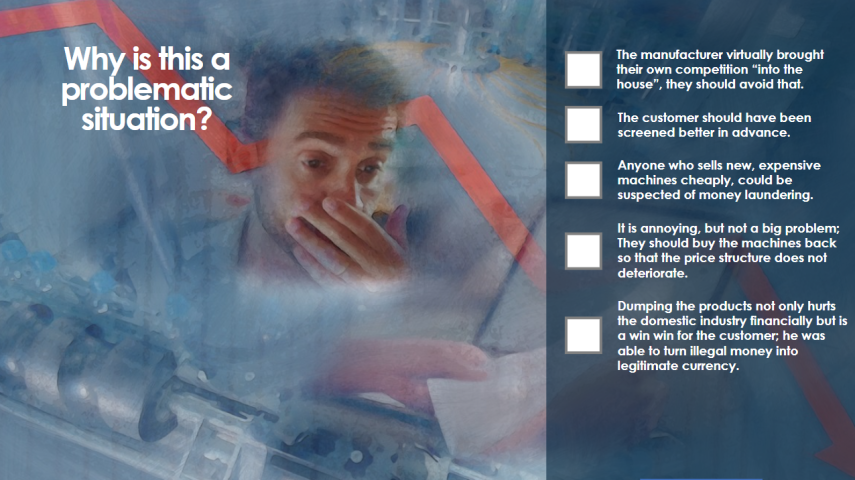

- 3. Detect money laundering: Methods and behaviour of money launderers

- 4. Principle of risk-based testing processes and screening methods

- 5. Legal requirements for "Know Your Customer" (KYC)

- 6. 3rd Party Compliance Interface

eLearning Features

-

Quiz questions

-

Interactive elements

-

Barrier-free (on request)

-

including certificate of participation

-

Extra assets (e.g. handout, promo video, poster)

-

Mobile-optimized (optional)

-

Variety of formats (e.g. video, gamification)

-

Available in the LMS or via our learning platform

Course Chapters

Your content is missing? We have more courses!

Would you like to add your own touch to the course content?

We individualise our courses to your content and design requirements.

Request nowStart training easily!

Easy integration of our courses into your LMS.

SCORM 1.2 | xAPI | HTML5

No LMS? No problem!

Our Online Academy offers a user-friendly training solution to train your own and other people's learning content digitally and easily.

Compliance

Training available in over 30 languages.